Stock futures up ahead of Fed speakers

MADRID (MarketWatch) - Stock futures pointed to a modest bounce for Wall Street at the open on Wednesday, with investors set to scrutinize comments by Federal Reserve members, and Target Corp. and Lowe's Cos. earnings are on tap.

The minutes of the latest Fed meeting will also be released later in Wall Street's session.

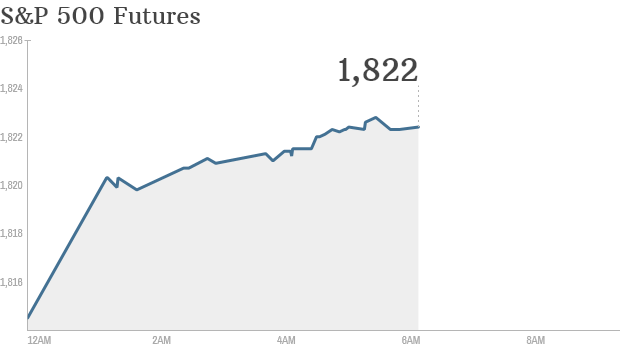

Futures for the Dow Jones Industrial Average rose 41 points to 16,378, while those for the S&P 500 index gained 5 points to 1,873.20. Futures for the Nasdaq-100 added 11 points, or 0.3%, to 3,607.50.

Ahead of a clutch of Fed speakers, earnings will roll out from names in the retail sector. On Tuesday, retailers helped drag the Dow industrials to a triple-digit loss, after disappointing earnings from TJX Cos. and Staples Inc. among others. Target, Lowe's, Williams-Sonoma are stocks to watch

Target will get particular scrutiny, given the retailer's weak performance over the past year. It is expected to report earnings of 71 cents and sales of $17.02 billion. On Tuesday, the company replaced the president of its struggling Canadian business.

Lowe's is expected to report earnings of 60 cents on sales of $13.89 billion. PetSmart Inc. is seen reporting earnings of $1.01 on revenue of $1.77 billion.

Yellen, Dudley speeches, minutes ahead

Federal Reserve Chairwoman Janet Yellen will deliver the commencement speech at Yankee Stadium for New York University students at 11 a.m. Eastern Time. The Fed chief is part of a busy Fed lineup for Wednesday.

New York Fed President William Dudley, who is a voting member of the Fed policy committee, will hold a quarterly press briefing on regional labor markets and economic conditions at 11 a.m. Eastern Time.

Kansas City Fed President Esther George, who isn't a voting member this year, will deliver a speech on economy and banking in Washington D.C. at 12:50 p.m. Eastern Time. Voting-member Minneapolis Fed President Kocherlakota will speak on monetary policy and the economy at the Economic Club of Minnesota at 1:30 p.m. Eastern Time.

Philadelphia Fed President Charles Plosser added to Wall Street's Tuesday woes after he said the Fed may need to act sooner rather than later if the economy accelerates.

Senate Majority Leader Mitch McConnell may have beat his conservative opponent, Matt Bevin, but he did so at the expense of millions of dollars. Republicans worry that the Kentucky Senate race could be the most expensive of the Midterms, and that it may negatively impact the party's reputation.

Investors will get a look at the minutes of the latest Fed meeting at 2 p.m. Eastern Time, which could reveal details of when, and by how much interest rates will be raised. The Fed continued to taper at its April 30 meeting, saying activity had 'picked up recently' after a winter slowdown.

In overseas markets, European stocks made small gains as investors kept an eye on key European Parliament elections and purchasing-manager index data due later in the week. U.K. stocks fell for a third day and the British pound jumped against the dollar after the release of minutes from the Bank of England's latest meeting that were viewed as hawkish.

Asia stocks posted moderate losses across the board, with the Nikkei 225 index off 0.6% and the Bank of Japan leaving its monetary policy on hold at its latest meeting.

Gold for June delivery posted moderate losses, while oil for July delivery rose 80 cents to $103.12 a barrel ahead of a report on U.S. supply data. Citigroup also raised its Brent oil forecasts for 2014 and 2015 on Wednesday.

More must-reads from MarketWatch:

Major U.S. benchmarks approach bull-bear tipping point

Portfolio killers: 5 common investing myths

Microsoft bills new Surface tablet as laptop-killer, aiming at Apple

Post a Comment for "Stock futures up ahead of Fed speakers"